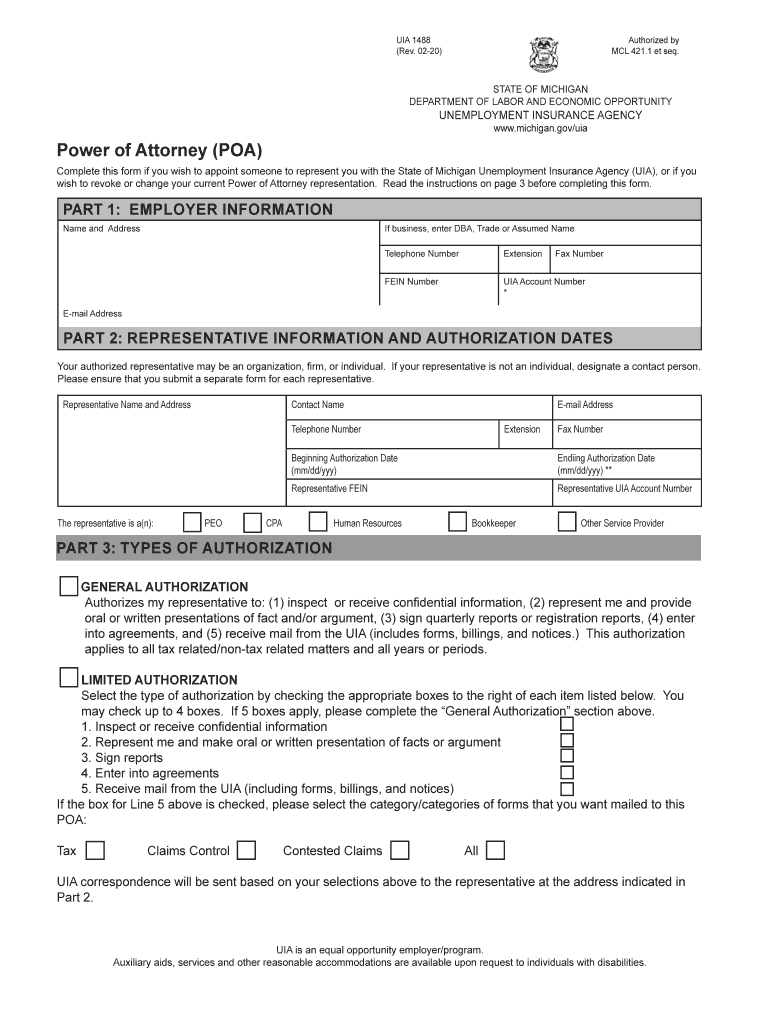

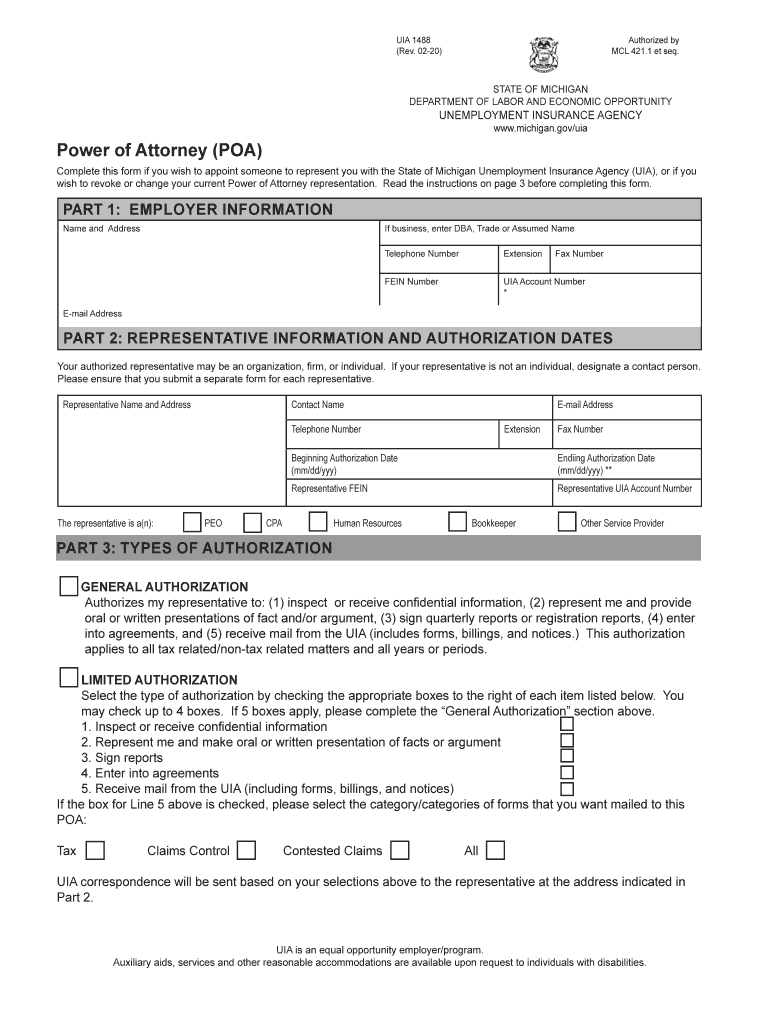

MI UIA 1488 2020-2024 free printable template

Get, Create, Make and Sign

Editing michigan uia power online

MI UIA 1488 Form Versions

How to fill out michigan uia power 2020-2024

How to fill out Michigan UIA power:

Who needs Michigan UIA power:

Video instructions and help with filling out and completing michigan uia power

Instructions and Help about form 1488 form

Doing your taxes for the first time as a young adult can be daunting I know this the first time I did mine I made my dad sit next to me the entire time I was filling out all of my forms, so I think one of the reasons it is so daunting is there's a lot of jargon I wanted to ask you tax girl about some of this jargon so to start what is it w to sew a w-2 is the simplest form that you're probably going to receive the w2 is the form that your employer would send to you, and you're going to find on that form all of your gross wages which is how much you should have gotten before Uncle Sam took anything out of it so your gross wages you're going to see any taxes that will withhold for federal state and local if that's applicable and this year more than ever you're going to be aware of box 12 which is going to report your health care benefits that were paid on your behalf if you had any and what is a 1099 in contrast that 1099 is going to be a form that's issued to you when you received money for working but not from an employer so not a regular gig but maybe if you're a freelancer if you perform services for different kinds of companies the 1099 tells you more or less the same information as the w-2 with one glaring exception which is that you're not going to see any federal taxes withheld because there's no withholding requirement when you work as an independent contractor, so that's why you're going to notice that your tax bill is a little higher if you're a 1099 taxpayer if as opposed to being simply a w-2 employee another form that I've been getting is the 1098 e right can you explain to our viewers what that is so most of you who went to college probably get to 98 e and the 1098 e is issued from your lender for student loans, and it outlines the amount of student loan interest that you paid during the year which can be somewhat depressing when you look at the number I'm the reason that you want to know that number though is if you qualify you can deduct your student loan interest on your tax return and the really cool thing about it is that you don't have to itemize to claim the deduction it's actually considered an above-the-line deduction, so you take it right off the top on the front of your tax form you don't have to itemize your deductions to claim now it is a deduction and not a credit which is something that confused me when I was 20 to can you explain the difference between deductions and credit and why in this case that's important in that show what deductions do is they chip away at your taxable income so if you have 50 thousand dollars in income and ten thousand dollars in deduction then you have forty thousand dollars of taxable income, so deductions are good, but credits are even better because credits chip away at the actual tax that you owe so if you owed five thousand dollars in tax, and you had a thousand dollar credit then you only owe four thousand dollars so if you do the math backwards you can actually figure out the...

Fill mi uia 1488 : Try Risk Free

People Also Ask about michigan uia power

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your michigan uia power 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.