MI UIA 1488 2020-2026 free printable template

Show details

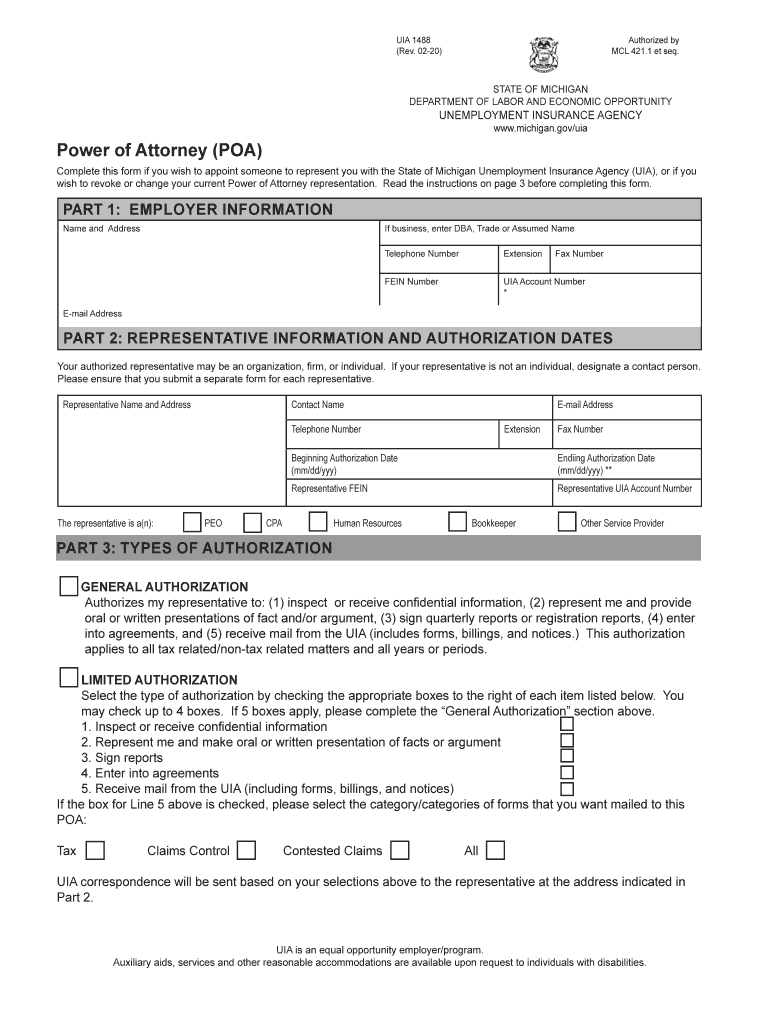

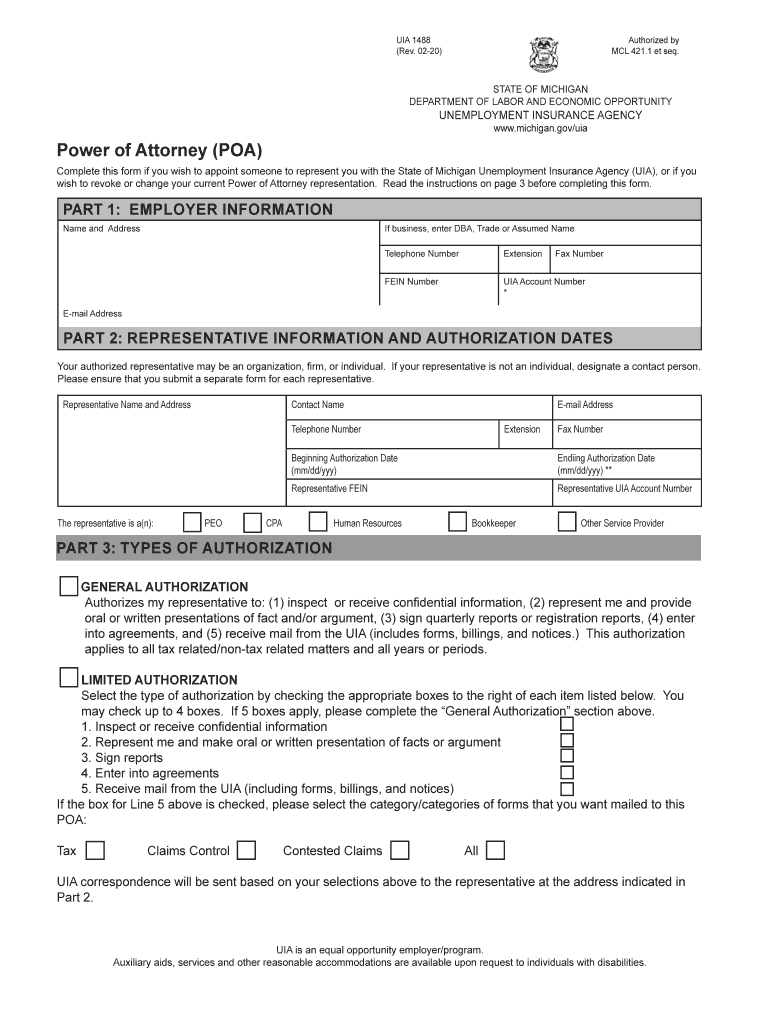

This form is used to appoint someone to represent you with the State of Michigan Unemployment Insurance Agency (UIA) or to revoke/change current Power of Attorney representation.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mi uia tax form

Edit your uia form 1733 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI UIA 1488 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI UIA 1488 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI UIA 1488. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI UIA 1488 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI UIA 1488

How to fill out MI UIA 1488

01

Obtain the MI UIA 1488 form from the Michigan Unemployment Insurance Agency website or office.

02

Fill in your personal information such as your name, address, and Social Security Number at the top of the form.

03

Provide your employment history, including previous employers, dates of employment, and reasons for separation.

04

Include information regarding any additional income or benefits you may have received.

05

Review the form for any errors or missing information.

06

Sign and date the form to certify that all information is correct.

07

Submit the completed form as instructed, either online or by mailing it to the appropriate address.

Who needs MI UIA 1488?

01

Individuals who have lost their job and are seeking unemployment benefits in Michigan.

02

Workers who are self-employed or have had their hours reduced due to circumstances such as the COVID-19 pandemic.

03

Those who need to apply for unemployment benefits for the first time or are reapplying after a previous claim.

Fill

form

: Try Risk Free

People Also Ask about

What is Michigan Form 518?

Attach this schedule to Form 518, Registration for Michigan Taxes and mail it to the Michigan Department of Treasury.

What is the UIA 1733 form?

What is a form UIA 1733? A UIA 1733 printable form is a document that is used by the Unemployment Insurance Agency in the state of Michigan. This form is used to request a determination of whether an individual is eligible for unemployment benefits.

What is UIA Schedule B in Michigan?

UIA Schedule B is included in the 518 Booklets, "Registration for Michigan Taxes," used by employers starting NEW businesses to register those new businesses for various kinds of Michigan business taxes, including unemployment compensation taxes.

What is form 518 Michigan?

Instructions for Completing Form 518, Registration for Michigan Taxes. Treasury will mail your personalized Sales, Use and Withholding Tax returns. UIA will issue your unemployment account number. Lines not listed are explained on the form.

Do I have to pay Michigan business tax?

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MI UIA 1488 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MI UIA 1488 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the MI UIA 1488 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign MI UIA 1488. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out MI UIA 1488 on an Android device?

Complete your MI UIA 1488 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MI UIA 1488?

MI UIA 1488 is a reporting form used in Michigan for employers to report employee unemployment insurance information to the Michigan Unemployment Insurance Agency.

Who is required to file MI UIA 1488?

Employers in Michigan who have employees and are subject to unemployment insurance laws are required to file MI UIA 1488.

How to fill out MI UIA 1488?

To fill out MI UIA 1488, employers should gather necessary employee data, complete the form according to the provided instructions, and submit it to the Michigan Unemployment Insurance Agency, ensuring that all required information is accurately reported.

What is the purpose of MI UIA 1488?

The purpose of MI UIA 1488 is to provide the Michigan Unemployment Insurance Agency with required information regarding employee wages and employment status to determine eligibility for unemployment benefits.

What information must be reported on MI UIA 1488?

MI UIA 1488 must report employee details such as the employee's name, Social Security number, wages earned, hours worked, and employment status during the reporting period.

Fill out your MI UIA 1488 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI UIA 1488 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.